As

the GST has been introduced in 2017, the main objective was to eliminate the

cascading effect i.e. tax on

tax by providing input tax credit on the every purchase of goods and services

which has been used in the course or furtherance of business as per the conditions specified under section 16 of CGST

Act, 2017.

Also,

as we know that input tax credit will reduced the cost of goods and services

and it will help taxpayer’s

to reduce his outward tax liability that has been arise at the time of supply by

utilising these input

tax credit.

But

in GST law, all input which are available and reflecting in GSTR-2A is not eligible

input and it can not be availed and

utilised against the outward tax liability. In other words, sub

section (5) of section 17 of CGST Act, 2017 as amended by CGST Amendment Act, 2018 specifies

the goods and services against which input tax credit

is not

available even if these are reflecting in our GSTR-2A. These input is

called “Blocked Credit”.

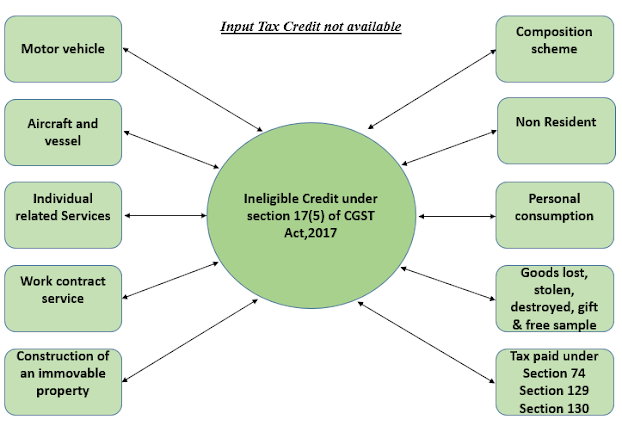

Let’s

have a look on the blocked credit according to his major heading i.e. against

which no input tax credit

is available.

The following is the services has been

description of these blocked credit.

|

Input tax credit not available

for specified goods and services

|

Exception i.e. Input tax credit

available subject to certain conditions

|

|

A. Motor

Vehicle - Used for transportation of persons

- Having seating capacity not more than 13

person(including driver)

|

Input tax credit is available

if used for: - Further supply of such motor vehicles i.e. car

dealer, automobile companies; or

- Transportation of passenger i.e. UBER, OLA

etc.; or

- Imparting training on driving such motor

vehicles i.e. driving schools

|

|

B. Vessel and aircraft

|

Input tax credit is available

if used for: - Further supply of such vessels or aircraft;

- Transportation of passengers i.e. Indigo, Air

India etc.

- Imparting training on navigating such vessels;

or

- Imparting training on flying such aircraft

i.e. training schools

|

|

Services of General insurance,

servicing, repair and maintenance related to such motor vehicle, vessels and

aircraft

|

Input tax credit is available

if used for: - Used for purposed specified above in point A

and B (exceptions)

- Taxpayer engaged in manufacturing of such

motor vehicles, vessels and aircraft or

- Taxpayer engaged in supply of general

insurance services in respect of such motor vehicle, vessels or aircraft

insured by him i.e.manufacturer of such motor vehicle is eligible to take ITC on insurance premium.

|

|

C. Individual

related services - Food and beverages, beauty treatment, health

services, life insurance, health insurance, renting of motor vehicle,

aircraft and vessels

- Member ship of a club, health and fitness

centre and travel benefits extended to employees on

vacation such as leave or home travel concession.

|

Input tax credit is available: - When an inward supply of such goods or service

or both is used by a registered person for making an outward taxable supply

of the same category of goods or services or both or as an element of a

taxable composite or mixed supply.

- Input tax credit is available if is it obligatory

for an employer to provide such goods or services to its employee under any

law for the time being in force.

|

|

D. Work contract service

- For Construction of an immovable property

|

Input tax credit is available if: - Work contract service used for plant and

machinery or

- For further supply of work contract service

|

|

E. Construction

of an immovable property: - Goods or services or both for construction of

immovable property on his own account

- Goods or services or both are used for furtherance

of business.

|

Input tax credit is available if: Construction of immovable property used for

plant and machinery Example: Cement base for towers,

advertisement pole etc.

|

|

F. Composition

Scheme

- Input tax credit is not

available if any goods or service or both received under which tax has been

paid under section 10 i.e. on composite rate of tax.

|

No such exception

|

|

G. Non-Resident - any goods or services or both received by a

non-resident taxable person

- Input tax credit is not available because he is

not registered under GST Act, 2017.

|

Input tax credit is available: On the goods imported by him and he take temporary GST registration under GST

Act,2017

|

|

H. Personal Consumption

- Any goods or service or both used for personal consumption, input tax

credit is not available because condition for availing input tax credit i.e.

for furtherance of business is not satisfied.

|

No such exception

|

|

I. Goods

lost, Stolen, damaged, disposed off, gift or free sample:

- No input tax credit available if any of the above circumstances

happened because in these cases there will be no outward supply from these

goods which has been lost, stolen, disposed-off etc.

|

No such exception

|

|

J. Any tax paid under Section 74, Section

129, Section 130 of CGST Act,2017

|

No such exception

|

There are some important ruling and case laws in respect of above goods or service or both. These are as follow:

- Mohana Ghosh, In re (AAR-West Bengal): Under this input tax credit is not available for purchase of motor vehicle for supplying Rent-a-Cab service.

- Advance Ruling: Chowgule industries (P) Ltd. 2019 taxmann,in 293 (AAR, Goa): Input Tax Credit is available for motor vehicle purchase as demo Vehicle for promotion of sale by providing trial run to customer and capitalised in books of account.

- CMS Infor System Ltd. In re (AAAR)2018: Under this input tax credit is not available for purchase of vehicle for transportation of cash.

- Nipha Exports (P) Ltd. in re to AAR (West Bengal): Under Individual related service at point C in the above table, Input tax credit is available only in respect of rent-a cab, life insurance and health insurance service if is it obligatory for an employer to provide such goods or services to its employee under any law for the time being in force.

- Maruti Ispat and Energy P Ltd. In re (AAR-AP).2018.: Under the Construction of immovable proper at point E in the above table ,input tax credit is not available for shed to protect plant and machinery as it is civil structure.

- Polycab Wires (P) Ltd., in re to AAR-Kerala)2019.: Input Tax Credit is not available for free supply of goods against CSR policy.

- Sanofi India Ltd., In re [2019] (AAR – Maharashtra).:Input Tax Credit is not available for free supply of goods for brand promotion or sales promotion.

Synopsis:

Under GST, for availing input tax credit subject to section 17(5), some of the basis conditions are as follow:

- Invoice has been received(invoice is mandatory)

- Goods or services or both has been delivered/received

- Tax on sale has been paid by supplier

- Invoice should be reflection in GSTR-2A

- Payment has been made within 180 days from the date of invoice

- use or intend to use for business purpose

- Outward supply should be non-exempted

- Claimed either input or depreciation etc.

For more useful updates please visit and follow https://taxtunnel.blogspot.com/

----------------------------------------------------------------------------------------------------------------------------

For any tax related issues/queries:

Please Contact:

Tax Tunnel

📱 +91-78382 12620

Very nice dear sir

ReplyDelete