Liability not reported or input not availed pertaining to Previous financial year ?

- Input tax credit which has not been taken related to previous financial year

- Invoices and liability not filed/paid in GSTR-1 and GSTR-3B respectively related to previous financial year

The above two cases have been explained below:

In GST, Input tax credit plays an important role for the businesses in terms of reducing cost of product, reducing output tax liability, removing cascading impact etc.

- Invoice not received/late received/misplaced

- Invoice not issued by supplier

- Goods or services or both not received/provided

- Debit note not issued by the supplier due to any reason

- Credit note not issued by the supplier due to any reason etc.

- Due date of filing of return under section 39 for the month of September i.e. 20th October; or

- Date of furnishing of annual return for the relevant financial year

Input Tax credit related to Credit Note:

- When excess tax has been charged in the tax invoice for the goods or services or both:, or

- The goods have been returned by the recipient based on the fact that goods or services or both found to be deficient.

Under Section 16(4) of CGST Act 2017 no time limit has been defined from the point view of recipient i.e. if the taxpayer has not reversed the input tax credit related to that credit note in the month to which it pertains, he has to pay the interest as per Section 50 of CGST Act 2017 from the date on which he has taken the input tax credit related to the tax invoice to the date of reversal at the time of filing his monthly return.

|

Period

|

Time

Limit as per Section 16(4) of CGST |

Remarks |

|

FY 2018-19 |

Earlier

of 20th Oct 2019 Or

Date of filing of Annual return |

-Due date for the month of Sep’19

return is 20th Oct 2019 - Date of furnishing of annual return for the FY

2018-19 i.e. 30th Sep 2020. |

|

FY 2019-20 |

Earlier

of 20th Oct 2020 Or

Date of filing of Annual return |

-Due date for the month of Sep’20

return is 20th Oct 2020 -Date of furnishing of annual return for the FY

2019-20 i.e. 31st Dec 2020. |

|

Period

of Credit Note |

Time

Limit to reversed input tax credit |

Interest |

|

Mar’2020 |

20th April 2020 |

Beyond time limit interest under

Section 50(2) @ 18%p.a. is applicable on the amount of credit note form the

date of credit note to date of reversal in the return |

|

April’2020 |

20th May 2020 |

- Invoice has been received(invoice is mandatory)

- Goods or services or both has been delivered/received

- Tax on sale has been paid by supplier

- Invoice should be reflection in GSTR-2A

- Payment has been made within 180 days from the date of invoice

- Use or intend to use for business purpose

- Outward supply should be non-exempted

- Claimed either input or depreciation etc.

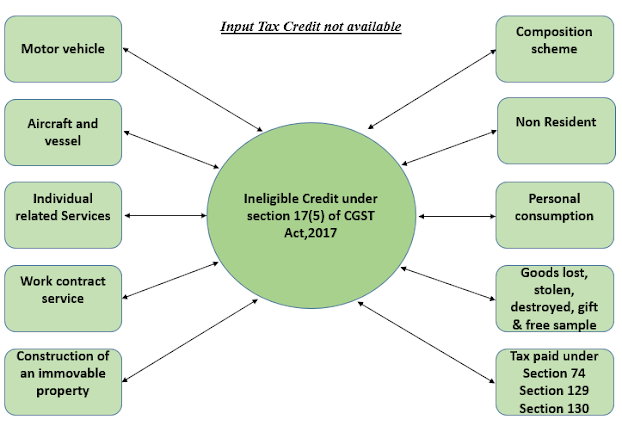

- Input should not be Blocked Credit as per Section 17(5) of CGST Act 2017.

|

Period

of Invoices |

Consider

in GSTR-1 |

Consider

in GSTR-3B |

Solution |

|

Jan’2020 |

NO |

NO |

Consider these invoices in the next

month GSTR-1 i.e. Feb’20 return Consider the liability in next month

GSTR-3B along with interest. |

|

Mar’20 |

NO |

Yes |

#Consider these invoices in the next

month GSTR-1 i.e. April’20 return. Also, in these case financial year has

also changed therefore, taxpayer has to disclose these value of invoices in

Annual return separately. |

|

Mar’20 |

Yes |

NO |

Consider the liability in next month

GSTR-3B along with interest. Also, in these case financial year has

also changed therefore, taxpayer has to disclose these liability in Annual

return separately. |

|

April’20 |

Yes |

No |

Consider the liability in next month GSTR-3B along with interest. |

Opinion:

Related to input tax credit:

As per our opinion and for the benefit of all the taxpayer, he can reconcile his input tax credit for the month with his GSTR-2A on regular basis because sometimes the taxpayer has not received the copy of invoice, debit note and credit note but supplier has uploaded in his GSTR-1 and same is reflecting in taxpayer’s GSTR-2A. Due to this, the taxpayer claim his input tax credit based on tax invoice and debit note and reverse his input tax credit based on credit note in a timely manner to avoid unwanted working capital crunch and interest implication respectively.

Related to output tax liability:

# Important: In GST Law, no time limit has been defined to file the invoices for the last year in the current month GSTR-1 but if we see Section 16(4) of CGST Act 2017, which states that time limit to claim the Input for the last financial year is up to the earlier of "due date of GSTR-3B of September and date of annual return'. Therefore, by considering section 16(4) of CGST Act, we are of the opinion that invoices for the last financial year must be filed on or before the due date of GSTR-1 for the month of September to avoid any unnecessary input queries from buyer's side.

For any tax related issues/queries:

Please Contact:

Tax Tunnel

📱 +91-78382 12620

Comments

Post a Comment