In order to provide relief to small taxpayers i.e. taxpayers having turnover below Rs. 1.5 Crore, the GST law provides the option of Composition Scheme. Under Composition Scheme the small taxpayers can get rid of tedious GST compliance's and pay GST at a fixed rate of turnover.

Key Features of Composition Scheme under GST

1) Eligibility : Everyone is eligible to register under composition scheme subject to certain turnover limits. The turnover limits are as mentioned below. Also, a composition dealer can supply the services to the extent of 10% of the aggregate turnover of the previous year or 5 Lakhs, whichever is higher.

2) Rate of GST : Composition Scheme being an Optional Scheme, the taxpayer who falls in the limits prescribed above and opts for this scheme has to pay GST as per the rates mentioned below.

3) Registration : A registered taxpayer under normal scheme can opt for composition scheme only from beginning of next financial year. Although, if the composition dealer want to switch to normal scheme during the year, he can do so.

4) Filing of GST Returns : Until, FY- 2018-19, composition dealers were required to file Quarterly returns by 18th of the month subsequent to the relevant quarter end in form GSTR-4.

However, from the FY 2019-20, composition dealers are required to file the Yearly GSTR-4 by 30th April of the following year.

5) Payment of GST : Composition dealers are required to make Quarterly payments using CMP-08 Form which is Challan cum Statement. In case the taxpayer fails to pay the tax on timely basis then Interest has to be paid at the rate of 18% per annum.

6) Non Eligibility : There are certain taxpayers which are not allowed to opt for composition scheme which are mentioned below:

- A Casual taxable person or a non resident taxable person;

- A registered person whose aggregate turnover has crossed the threshold limit.

- Person making Inter State Outward Supplies of Goods;

- Supplier who make any supply of goods through an electronic commerce operator who is required to collect tax at source under section 52;

- a manufacturer of Ice cream and other edible ice, whether or not containing cocoa, Pan Masala, Tobacco and manufactured tobacco substitutes.

Other Important aspects for Composition Dealer

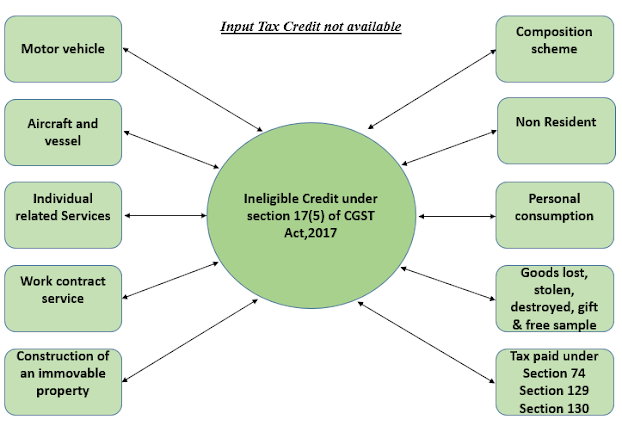

1) As per Section 16, goods or services on which composition tax has been paid (under section 8) do not apply for Input Tax Credit (ITC). Nor the composition dealer can claim ITC for the purchases made by him.

2) A composition dealer can only make Intra-State supplies, Inter-State supplies are not allowed. However, Inter state purchase can be done.

3) A composition dealer has to issue Bill of Supply (mentioning "Composition taxable person. not eligible to collect tax on supplies") instead of Tax invoice and he cannot charge GST from the customers.

4) Earlier it was a provision to pay composition GST even on the exempted goods but after 1st January 2018, the GST will be only payable on the taxable goods.

5) The taxpayers who want to opt for the Composition scheme have been instructed that they will not be filing GSTR 1 or GSTR 3B for the FY 2020-21 through any GSTIN or registered PAN. If the assesses fails to do so, then they will not be provided an option to opt for the Composition Scheme.

Due Date for Filing GSTR-4

Government vide

Notification No. 59/2020 - Central Tax has further extended the due date to file

GSTR-4 for the FY-2019-20 till

31st August 2020 which was previously extended till 15th July 2020.

For More upcoming Changes in GST Returns do refer below link:

----------------------------------------------------------------------------------------------------------------------------

For any tax related issues/queries:

Please Contact:

Tax Tunnel

📱 +91-78382 12620

Comments

Post a Comment